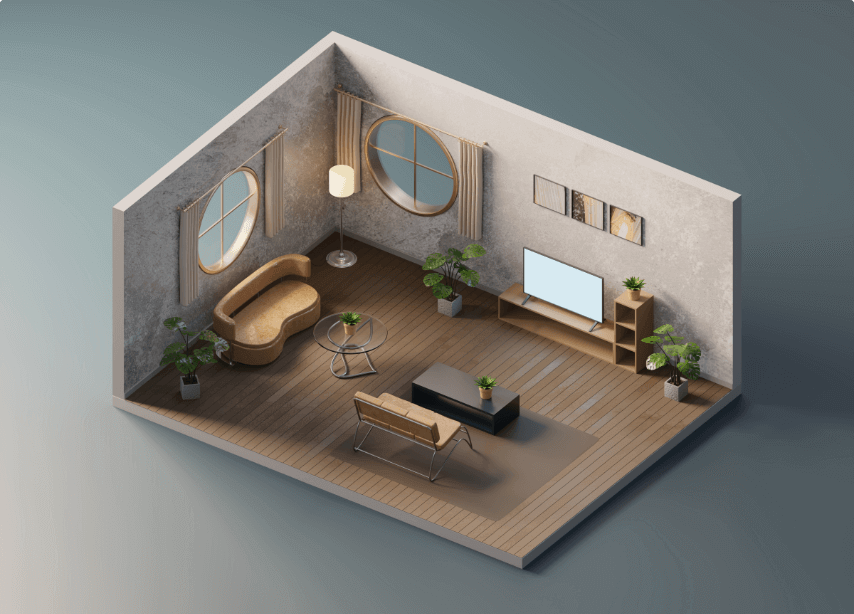

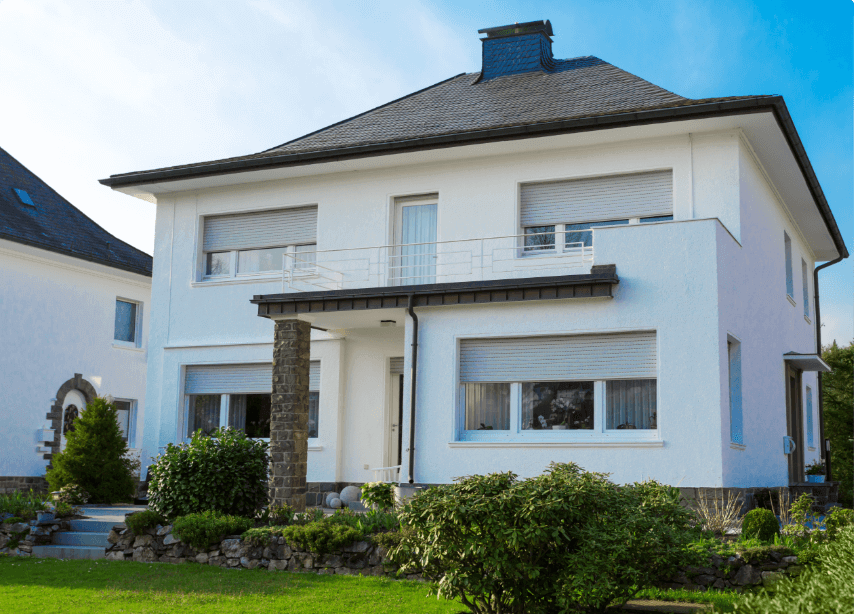

Home loan

A home loan, also known as a mortgage, is a financial arrangement that enables individuals to purchase or refinance a home by borrowing money from a lender. This loan is typically repaid over a fixed period, often ranging from 15 to 30 years, through regular monthly payments that include both principal and interest. Home loans come in various types, including fixed-rate mortgages, where the interest rate remains constant, and adjustable-rate mortgages, which have interest rates that fluctuate based on market conditions. Specialized home loans, such as FHA loans, VA loans, and USDA loans, cater to specific groups like first-time buyers, veterans, and rural homebuyers, often offering lower down payment requirements and more favorable terms.

Business Loan

A business loan is a financial product designed to help entrepreneurs and established businesses access the capital needed for various purposes, such as expanding operations, purchasing equipment, managing cash flow, or investing in real estate. These loans can come in different forms, including term loans, lines of credit, and equipment financing, each tailored to meet specific business needs. Business loans are offered by banks, credit unions, and alternative lenders, with terms and interest rates varying based on factors such as the borrower's creditworthiness, the amount of the loan, and the repayment period. By providing crucial financial support, business loans play a vital role in helping companies grow, innovate, and succeed in a competitive market

Car loan

A car loan is a type of financing that allows individuals to purchase a vehicle by borrowing money from a lender, such as a bank, credit union, or online financial institution. The borrower agrees to repay the loan amount, plus interest, over a set period, typically ranging from three to seven years. Car loans can come with fixed or variable interest rates, with fixed rates providing predictable monthly payments and variable rates potentially offering lower initial payments but with possible fluctuations over time. Securing a car loan usually requires a credit check, and the terms of the loan, including the interest rate and repayment schedule, are influenced by the borrower’s credit score, income, and overall financial health.

surekhan15457@gmail.com

surekhan15457@gmail.com